|

It wasn’t long ago that individuals with disabilities had little control over their personal finances. Any funds and benefits received from federal and government sources prohibited recipients with disabilities the opportunity to save and plan for their future appropriately. In 2014, this very unfair financial stipulation was changed.

As a parent of a teen with autism, who was on the waiting list for therapeutic, respite and treatment services for over ten years, I was repeatedly warned to make sure that my son Richie had no monetary assets that exceeded two thousand dollars. This didn’t guarantee his services would be rendered sooner, it just meant he wouldn’t be eligible for those services when and if his time came to receive them. So, when grandparents and other family members offered to send checks to put into Richie’s savings account, open education IRA’s in his name and other monetary sources that would assist him in the future were offered, I had to sadly decline their generous gifts and offer other ideas instead.

There were other options, such as Special Needs Trust accounts set up by very expensive attorneys, but I didn’t have the funds to do this, plus, many traditional trusts required a minimum of fifty thousand dollars just to open an account. I wanted to open an account with a few hundred dollars and start building from a place my family could afford. There are special needs trust agencies that are held by the non-profit agencies that are more affordable than attorneys. However, many of them come with expensive start-up costs, monthly, quarterly and annual fee’s that I still couldn’t afford.

When I was first introduced to the ABLE Act and ABLE United last year, naturally I was thrilled. This meant my family and son now have a fighting chance to plan for Richie’s future effectively. The ABLE Act amends section 529 of the internal Revenue Service Code allowing each state to create tax-advantaged savings accounts specifically for individuals with disabilities. Richie is now eligible to receive services from the Florida Agency for Persons with Disabilities and ABLE United makes it possible for us to save without losing benefits. The ABLE act now allows individuals with disabilities to save up to $14,000 annually without impacting government benefits.

Please note that this post is sponsored by ABLE United through a Bloggin’ Mama’s campaign, but these opinions are my own. In fact, I opened an account for my son Richie as soon as I could. We save regularly for Richie’s future now. We have a plan and it’s affordable and it helps me to rest easier knowing we can prepare for the unknown and support Richie when he needs it.

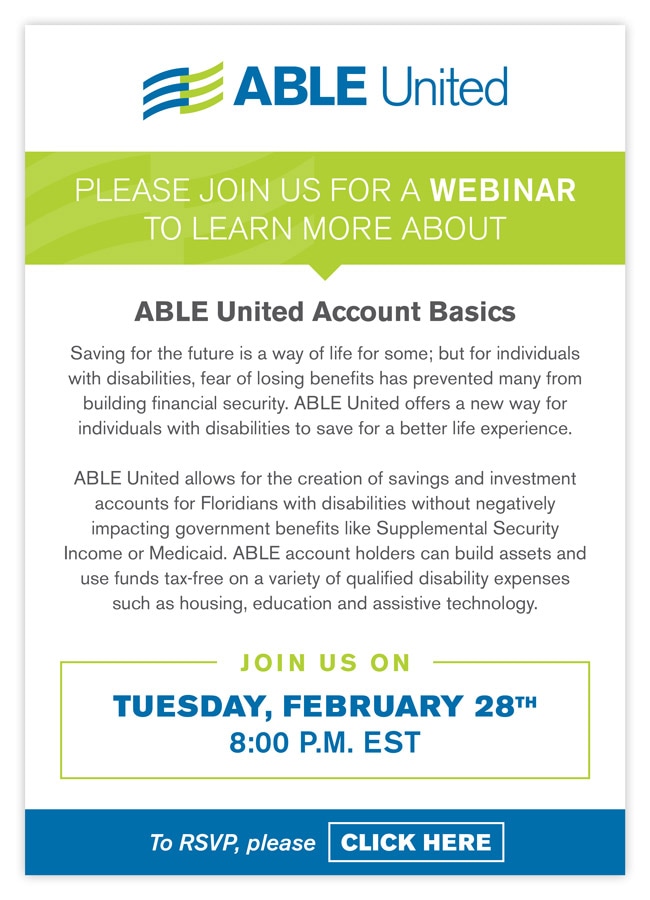

If you or your family member has a disability, you'll want to register for an ABLE United webinar that will be held on February 28, 2017. Register for the webinar entitled, “ABLE United Account Basics.”

Sincerely, Christine SensoryFriends

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Author: Christine Goulbourne

|

RSS Feed

RSS Feed